As a renter, you may find the prospect of owning your home very attractive. You can make permanent changes, and earn equity with each monthly payment. Still, renters should begin by considering all aspects of renting vs. buying.

5 Key Considerations for Renting vs. Buying a House

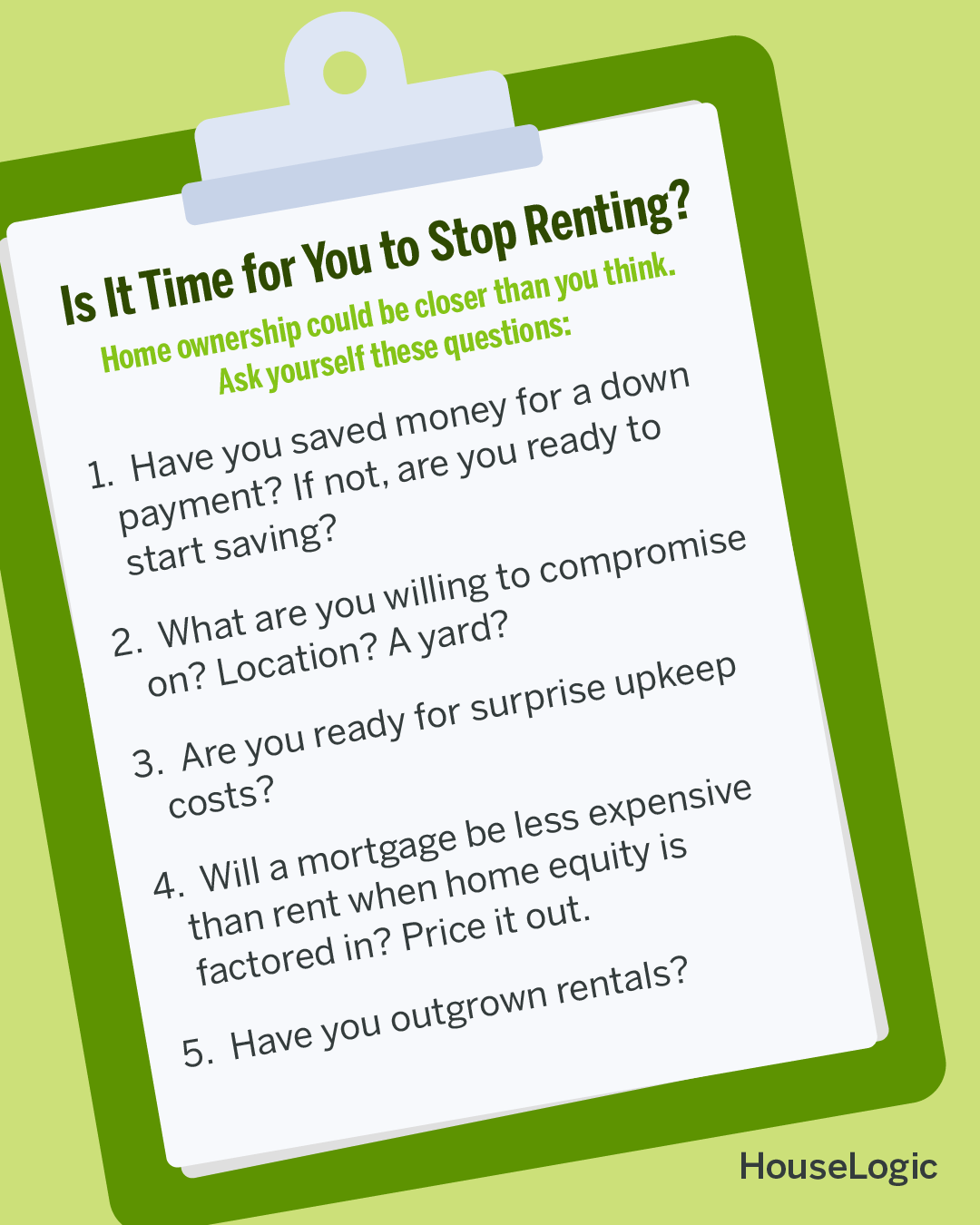

The best time to trade a landlord for a mortgage lender is different for everyone. But if you're considering doing that now, these five factors can help you figure out if you're ready to buy a home or should keep renting for a while.

#1 Buying May Involve More Upfront Costs Than Renting

Let's not beat around the bush: Buying a house requires a substantial financial commitment when compared to renting. But buying offers a significant benefit as a tradeoff: equity in a property you’ll own.

Home buying costs begin with the down payment, of course. The typical down payment for first-time buyers is 8% of the cost of the home targeted, according to the 2023 "National Association of REALTORS® Profile of Home Buyers and Sellers." Then, add 1.2% to 2.47% of the home's purchase price for closing costs, which will vary based on where you live and what taxes your state and city require you to pay.

Tip: If you put down less than 20%, you'll pay private mortgage insurance, which protects the lender in case of default. Usually, PMI costs about .5% to 1.5% of the loan amount per year, but costs vary by loan program, your credit score, and other factors. Once you reach a certain threshold on your loan to value ratio, you can cancel PMI.

A healthy credit history is also important. Most borrowers will start to qualify for a mortgage with a minimum score of 620, — but the most competitive interest rates will be offered to those with a score of 740 or higher. So, if you haven't started practicing those good credit habits yet, it's time to start developing them.

One of the trickiest hurdles for young adults, who may be lugging around student loan debt, is the debt-to-income ratio. Mortgage companies want borrowers to have a certain level of cash flow each month, and that means taking into account so they look at how much you're paying out to other lenders. Ideally, a borrower's debt-to-income ratio — how much you pay toward debt each month divided by your gross monthly income — should fall below 36%. Different mortgage programs have different requirements, but generally staying at or under 43% is advisable. If your DTI is outside that range, think about how you can get that debt needle moving in the right direction.

You can do that by paying off unsecured debts like credit cards and personal loans and keeping them as close to a zero balance as possible.

#2 Buying May Involve More Compromise

Kathleen Celmins, currently CEO and co-founder of a content marketing agency, was financially prepared to manage a mortgage. But once the house hunting began, she quickly realized she was priced out of the homes she had envisioned for herself.

"I originally wanted a single-family home with a yard and in a great neighborhood," she says. But the homes she could afford ended up being in, well, not the greatest neighborhoods. "At one point, we looked at a property that was directly behind a strip club," she laughs. "We didn't even go inside." After several weeks of searching, Celmins realized she needed to find a middle ground. "In my price range, I could get a not-so-great house in a not-so-great neighborhood. Or, I could get a really cute condominium with a gas range and granite countertops," she says. "It was something I compromised on. I gave up a yard to have fancy stuff in my condo."

#3 Buying Involves More Financial Surprises Than Renting

When it comes to renting, you have flexibility when surprises hitsurprises don't require much emotional investment. The rent goes up? You can move. The fridge is on the fritz? The landlord will send someone over. Home ownership is more hands-on. If the toilet breaks, it's time to start reading Yelp reviews. And if property taxes unexpectedly rise, it's on you to appeal or pay up.

"My homeowners association fee doubled in the first year I owned my condominium," says Celmins. "Then my real estate taxes were reassessed. My mortgage payment went up, and I panicked. I didn't even know that could happen." Of course, having the financial flexibility to cover those unexpected things is important, but don't overlook the importance of being mentally and emotionally capable of dealing with them responsibly when they arise. Everything could be peachy for months, and then three maintenance issues might spring up in the same week. Stress management and problem-solving skills are home ownership biggies.

Although renters don’t usually pay for maintenance and repairs, they don’t have much control over the timing (you may need patience when the AC conks out) or the quality of a replacement or a repair.

#4 Mortgages Can Be Cheaper Than Rent

Depending on the home you choose and where you live, you may pay a lower mortgage than you paid for rent. But even if you don't, there's still the financial advantage of building equity in your home, instead of lining your landlord's pockets.

#5 Your Lifestyle May Call for Buying Instead of Renting

Many people find a rental can only take them so far. When you're ready to start a family, you're going to want a few extra rooms, and that can get expensive with rising rental rates. A yard also provides a safe place for Junior to play or for a dog to scamper around. And speaking of your dog, most renters have trouble finding a place that will allow their pet. Home ownership can end that stress for good.

Then there are the renovations. If you're itching to test out your DIY skills and personalize your space, you're probably ready to own. Landlords who allow property renovations — especially DIY projects — are few and far between. Buying a first home is a big change, both financially and emotionally. Still, for many, home ownership can be one of the most rewarding life choices they can make. "Turns out it's awesome," says Celmins.

Should You Keep Renting or Buy a House?

Ultimately, the decision will come down to you and several personal factors. Renters must consider criteria such as personal finances and budget, inventory, desired location, and lifestyle. Consider contacting a real estate agent to learn more about what goes into buying a home. They’ll likely be able to provide useful information to help you decide.

You May Also Like: