Especially when you’re buying your first home, you want to consider all your options. That’s even more important when affordability and supply are challenges. You may be unaware of the option of a housing cooperative, or co-op housing. Or you may may think co-ops are exclusive to New York City. But they do exist elsewhere, although they’re concentrated in certain areas. Here’s what you should know about co-ops and whether they might make sense for you.

What is Cooperative Housing?

A real estate cooperative is a communal housing type that originated in New York City, says Andrew Kontzamanis, associate attorney at Serpico, Serpico & Siddiqui, P.C. in Brooklyn, N.Y. He regularly represents co-op buyers and sellers, co-op corporations, and lenders. For a few years, he was a co-op shareholder-tenant, and he currently sits on the board of a co-op in Brooklyn.

One distinctive feature of a co-op is that the buyer is purchasing stock in the corporation that owns the co-op’s land and structures. Shares purchased are allocated to specific units. The tenant-shareholder has a lease with the corporation that establishes the respective rights and responsibilities in occupancy, maintenance and repair, and other matters, Kontzamanis says.

“The co-op corporation, not the shareholder, is typically the sole owner of the property and structures on which the co-op exists,” Kontzamanis says. “Some co-ops are long-term – for example 99 years – tenants of a building or property.”

The co-ops’ elected board of directors governs the corporation’s affairs, usually authorizing a professional management firm to handle day-to-day activities. Those might include cleaning and accounts payable.

How Does Co-op Housing Work?

Co-ops and condos are both types of communal housing, but co-op housing works differently from condos in several ways:

- Co-op ownership is represented by a stock certificate and lease; condo ownership, by a deed to real property, Kontzamanis says. With condos, you don’t own shares; instead you own the actual unit where you reside, says Jeffrey Schwartz, managing partner at law firm Schwartz Sladkus Reich Greenberg Atlas LLP, in New York City. Schwartz represents a large co-op and condo practices in New York City.

- Condo buyers in New York State pay a mortgage tax on funds borrowed to buy a condo unit. No such tax is levied on funds borrowed to buy a co-op, Kontzamanis says.

- “Most often, a co-op cannot be bought or sold without the board of directors’ consent,” Kontzamanis says. “Such consent is not required for a condo transfer, although many condominiums do have a right of first refusal to purchase a unit that is for sale.”

- Co-op housing is less common than condos in the U.S., so co-ops are in a niche market, says Alexei Morgado, CEO and founder of Lexawise, a real estate exam preparation company in The Woodlands, Texas. Condos are available in urban, suburban, and rural settings, but co-op housing is more localized. Co-ops are highly concentrated in New York City, with about 75% of Manhattan’s apartment ownership market comprised of co-ops, Morgado says. “There are some co-ops outside of New York City, particularly in cities such as Chicago, Washington, D.C., and Minneapolis, but they are very few compared to condominiums. Traditionally, co-ops have been found in locations that prize accessibility and shared ownership. They are generally high-rise or multi-unit buildings that appeal to people [interested] in shared amenities and a close community atmosphere.”

The Pros and Cons of Cooperative Housing

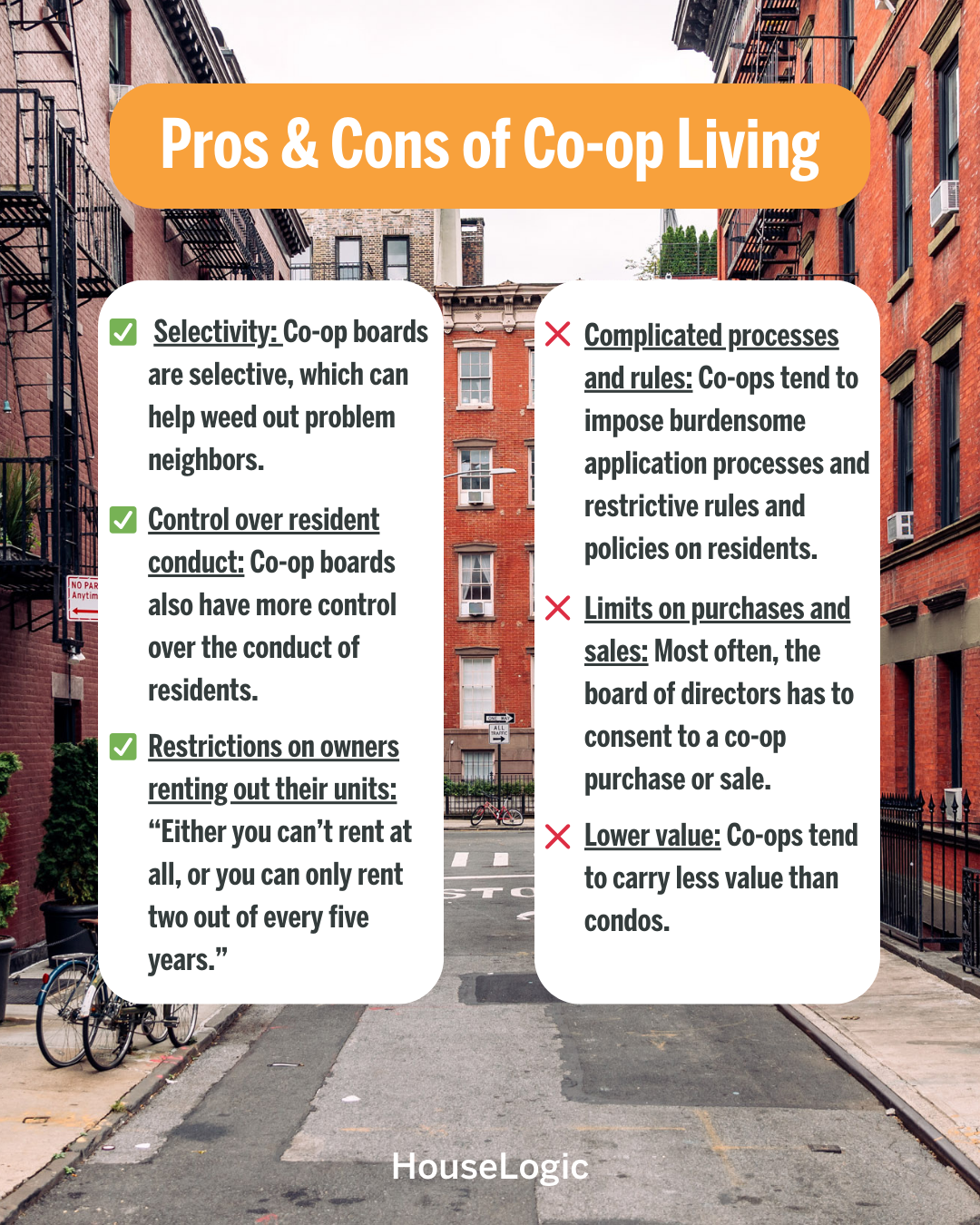

Like all housing types, co-ops have pros and cons.

Co-op Housing Pros

- Selectivity: Co-op boards are selective, which can help weed out problem neighbors. The boards of co-ops have much greater latitude to decide whether a newcomer can move in, Schwartz says. “They can do a much more thorough analysis, meet the individual and get references,” he adds. “That could be a positive or negative, as some boards might use that power for good or bad.”

- Control over resident conduct: Co-op boards also have more control over the conduct of residents, Schwartz says. That could result in less-disruptive behavior from neighbors. “If the conduct is not conducive to communal living, the board has a weapon – the right to evict – to remove the individual from the building,” he says.

- Restrictions on owners renting out their units: “Either you can’t rent at all, or you can only rent two out of every five years,” Schwartz says. “I always like to see buildings where there is a large percentage of owners who occupy as opposed to renting their units out."

Co-op Housing Cons

- Complicated processes and rules: Co-ops tend to impose burdensome application processes and restrictive rules and policies on residents, Kontzamanis says. “[Condos] afford owners more flexibility for renting or renovating their units.”

- Limits on purchases and sales: Most often, the board of directors has to consent to a co-op purchase or sale, Kontzamanis says. “Such consent is not required for a condo transfer, although many condominiums have a right of first refusal to purchase a unit that is for sale,” he adds.

- Lower value: Co-ops tend to carry less value than condos. Condo owners have fee-simple ownership of their units. “The market values that as higher than it would stock ownership in a property as a lessee under a proprietary lease,” Schwartz says.

How to Finance Co-op Housing

When it comes to applying for financing, the process for co-ops is remarkably similar to financing other housing types, Kontzamanis says. “Lenders evaluate applicant income, assets, and credit, as well as the value of the co-op unit itself,” he says.

“The borrower will execute a note and security agreement in favor of the lender,” Kontzmanis says. “And a UCC-1 [Uniform Commercial Code] Financing Statement will be recorded in the local clerk’s office to reflect and protect the lender’s interest. When applying for a co-op loan, it is best to work directly with a local lender rep [with] experience with co-operative lending.”

When you’re looking for a real estate professional who knows the co-op market, similar advice about going local applies. “I would find someone local,” Schwartz says. “In New York City, agents have a tendency to know the whole market. You don’t see agents here who only do the East Side or only do the West Side. In towns and local areas, the broker in that area will be the most familiar with co-ops and properties in that same area.”

Questions to Ask About Co-op Housing

You'll want to ask questions to evaluate a co-op you may be considering and to double-check your comfort level with co-op housing processes, rules and regulations. Here are three to start with.

- How well run is the business? When you buy a co-op, you’re purchasing into a business. Would-be buyers should try to ensure the business they’re considering is very well run, Schwartz says. “We look at the offering plan, the minutes of the board meetings, and what capital expenses will come up down the road,” he says. “For instance, will there be a boiler or a roof replacement required in the future? We also generally have conversations with both the building’s managing agent and the building’s accountant.”

- Am I willing to divulge all my financial records in the application process?

- Am I willing to be bound by the co-op’s rules and regulations?

If co-op housing is an option in your market and you think you might be interested in pursuing one, make sure to do some legwork. Most importantly, carefully weigh the pros and cons for both this type of housing and any specific building you’re considering.