Nathan Fiorini and Amber King have been best friends for 10 years. “Even our dogs are friends,” Fiorini says. Both moved from Arizona to Seattle for job opportunities in 2017. They shared a rental until 2021, when both were ready for a change. King wanted to buy a house. Fiorini says he couldn’t afford that and was looking to rent, “but we really didn’t want to break up our household.” Neither could have afforded a home in Seattle on their own, so they decided to pool their resources. That idea of co-ownership of a house with a friend or family member has been gaining traction.

With help from CoBuy, King and Fiorini ended up buying a 1,400-square foot fixer-upper for $510,000. That was a bargain in Seattle, where the average home value is $815,513, according to Zillow.

First-time home buyers in particular are seeking co-buying solutions to overcome home affordability hurdles. Purchasing a home – a person’s biggest investment and largest wealth generator – is challenging now because of high home prices, low inventory, mortgage rates, and increased debt burden.

In 2025, over 61 million Americans co-own a home with someone who isn't their spouse — nearly 20% of the population, according to CoBuy, a startup that helps individuals interested in purchasing a home together. And 30% of all U.S. home sales are transactions with co-buyers, CoBuy reports.

If you really want to buy a home, co-buying is a great option, but there are factors to consider for a successful outcome. Here’s how to decide if it’s right for you and to make it work.

Defining Housing Co-Ownership

Basically, co-buying means you’re pooling resources with others, usually friends or family, to purchase property. When the parties become co-owners, their names are on the title and likely on the mortgage.

“[Co-ownership] is not a timeshare,” says Don Koonce, REALTOR®, broker, and CoBuy-certified professional with Windermere in Seattle. “If you co-own, you live there permanently,” or you co-own as an investment and rent out the property.

Mortgage Pros and Cons in Co-Ownership Housing

You don't need a special mortgage loan when you're looking at co-ownership housing with one or more people, according to Freddie Mac. You may want to compare several lenders, though, because some may limit the number of people listed on the loan.

However, lenders will review the loan application for combined incomes, assets, debt-to-income ratios and credit scores to determine your collective eligibility, Freddie Mac says. Having multiple incomes or a co-borrower with strong credit can make it easier to qualify.

When one or more people apply for a mortgage loan, they are typically listed as co-borrowers and become jointly liable for the mortgage payments, according to Experian, a consumer credit reporting company. When you apply for a mortgage loan, your lender will usually review both or all of the co-borrowers' incomes, assets, debt-to-income ratios, and credit scores to calculate eligibility.

Having two incomes often helps co-borrowers qualify for higher loan amounts and possibly better terms, Experian says. Also, if one co-borrower has strong credit and predictable income, that can be a big plus if the other co-borrower needs to improve their credit, needs payment assistance, or doesn't have the income to qualify for a mortgage loan on their own.

Housing co-ownership has pros and cons from several perspectives. Darcie Gore, executive director and senior lending manager with JP Morgan Chase, offers these pros and cons from a mortgage lending perspective:

| Pros of Housing Co-Ownership | Cons of Housing Co-Ownership |

| The odds for mortgage approval are better. | Each co-owner is responsible for monthly mortgage payments even if one or more buyers fall behind. One person’s delinquency could harm each co-owner’s credit score. |

| Co-owners can put down a larger down payment, which would likely lead to a better loan offer. | With several buyers, calculating the debt-to-income ratio needed for purchase can be complicated, which may affect additional credit. “Lenders [may] think twice before approving any additional credit,” Gore says. |

| Costs are lower, because co-owners split costs such as the mortgage and big repairs. | If you relish control, particularly over money, co-buying or co-owning may not be for you. “Many decisions require the approval of all buyers, which might slow down the process and potentially create conflict among the group,” Gore says. |

| The home buying process is speedier, since the down payment is smaller per person. |

Mortgage and Deed: Co-Ownership Housing Documents

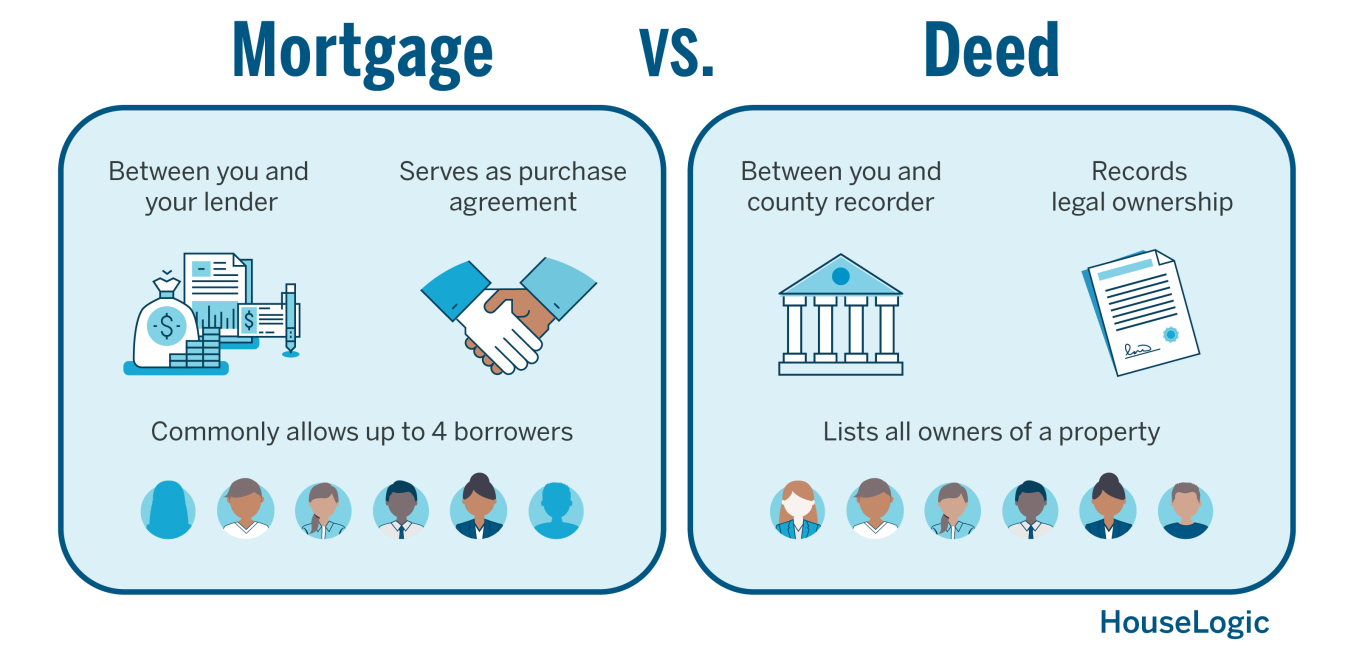

As in other home purchases, two documents -- a mortgage and a deed -- will be involved:

- A mortgage is a purchase agreement for a loan. The mortgage is debt. There’s “no strict legal limit to how many borrowers can be on one loan, but lenders generally try to limit it to four borrowers on a single loan, and each borrower is subject to the same qualifications for the loan,” Gore says.

- A deed is a physical document showing who has ownership. The word “deed” is often used interchangeably with “title,” but the title is really the idea behind the deed.

It’s possible to be listed on a deed and not be a mortgage holder. Home buyers may make this choice if one owner doesn’t have good credit.

Ways to Structure Co-Ownership Housing

There are a few ways to own a house in a co-ownership situation.

- Tenants in common. Let’s say there are two buyers, Al and Betty, each of whom has 50% ownership. Al dies, leaving everything in his will to his brother. Betty still has 50% ownership, but she’s now sharing it with Al’s brother. With TIC, co-owners may sell or transfer their ownership to someone else without consent from other co-owners. It would be “extremely rare for a share to be sold,” says David Sachs, a real estate attorney in Metuchen, N.J. “What’s more common is an owner filing a complaint for partition to force the other to buy them out or to sell.”

- Joint tenants with right of survivorship, aka “joint tenancy.” Engaged couples often choose this option. Each person has equal rights to the property, and if one dies, the other inherits. Related to this term is “tenancy by entirety.” This agreement is solely for married couples. If one precedes the other in death, the home is already fully owned by the surviving owner. If they divorce, the agreement usually converts to TIC.

- Limited liability company. You would enter into an LLC, a business partnership that offers protection for the owners by separating personal assets and debts from business assets and debts. Keep in mind that filing fees are needed to create the LLC, and it may be more difficult to get a mortgage.

- Trust. Rather than putting property into the owners’ individual names, you would deed the property into a trust, essentially a separate entity. The trust owns the home, and you become a trustee in charge of the trust. When you set it up you would determine who the beneficiaries would be if you died. The trust owns the home after your death, and the beneficiaries become the trustees.

Sachs says co-buying friends most often choose to own as tenants in common. Consider these pros and cons.

Pros of tenants in common structure:

- Ownership percentages can vary for each co-buyer. For example, Fiorini and King own 34% and 66% of their home, respectively.

Cons of tenants in common structure:

- You may end up owning a home with a stranger.

- If one co-buyer faces a legal judgment, all co-buyers are on the hook.

Limit Risk in Housing Co-Ownership

You could limit your liability by purchasing a home with a co-buyer with whom you’ve created an LLC, a separate entity that helps protect your personal assets. Or you can enter into an LLC as an individual by becoming a single-member limited liability company. “Your risk goes only so far as the amount you’ve invested," Sachs says. This isn’t common, and the biggest obstacle here “is if you’re looking for a mortgage, a lender might not lend to an LLC,” he adds. “And if they do, you’d likely pay a higher interest rate.”

Tax implications will also exist. If you’re determined to limit risk, you could get a mortgage in your name and do a “quit claim deed” to an LLC, where you’d transfer ownership from you to the LLC. Most often, though, an LLC is used when co-buyers purchase a home as an investment.

Each state has different rules, so consult a real estate lawyer in your state for the information you need to make the right choice.

Create a Housing Co-Ownership Agreement

Your goal may be to own a home, but you don’t want to ruin relationships in the process. The best solution is to create an agreement up front. “It should cover everything,” Koonce says. “You have to play out all the scenarios ahead of time so you can go into the agreement with more confidence.”

Here are three tips to reduce problems in co-ownership housing:

Anticipate Housing Co-Ownership Conflicts

CoBuy required Fiorini and King to create a contract documenting how they would co-own their home. “We talked about what would happen if one of us passes, what to do if we didn’t agree on the sale time and price, what to do if one of us got into a long-term relationship, how often visitors could stay, how to respect one another’s privacy, how to deal with maintenance issues,” Fiorini says. This information was all documented in writing.

Explore Cohabitation and Property Agreements

You can do this step on your own by downloading a cohabitation agreement (free templates are available online), which details each co-buyer’s responsibilities. Note that your state may not recognize this type of agreement. If you each bring furniture or appliances to the arrangement, you can protect yourselves with a property agreement.

You and your co-buyer or co-buyers should genuinely understand how to trust each other with money and finances, Fiorini says. “If you can’t talk about cash, you can’t buy a house together. It just won’t work.”

Plan an Exit Strategy for Housing Co-Ownership

CoBuy also required Fiorini and King to plan an exit strategy. “We bought with the specific mindset that we’d renovate the house and only own it for three to five years,” Fiorini says. “We talked about how to set a sales price. We decided that if we disagreed, we’d take the average of three REALTORS®’ assessments.”

After four years of co-ownership, Fiorini and King are ready to sell and co-buy a larger house in Seattle. Fiorini says, “Talking upfront about all the ugly things that no one wants to accept as realities in life allowed us to preserve our friendship.”