So you’re thinking about buying your first home. Your very own house (and mortgage). A place to call — and make — your own.

It’s a big move, literally and figuratively. Buying a house requires a serious amount of money and time. The journey isn’t always easy or intuitive. But when you get the keys to your new home — that can be one of the most rewarding feelings ever.

The key to getting there? Knowing the home-buying journey. Knowing what tools are at your disposal. And most importantly? Creating relationships with experts who can help you get the job done.

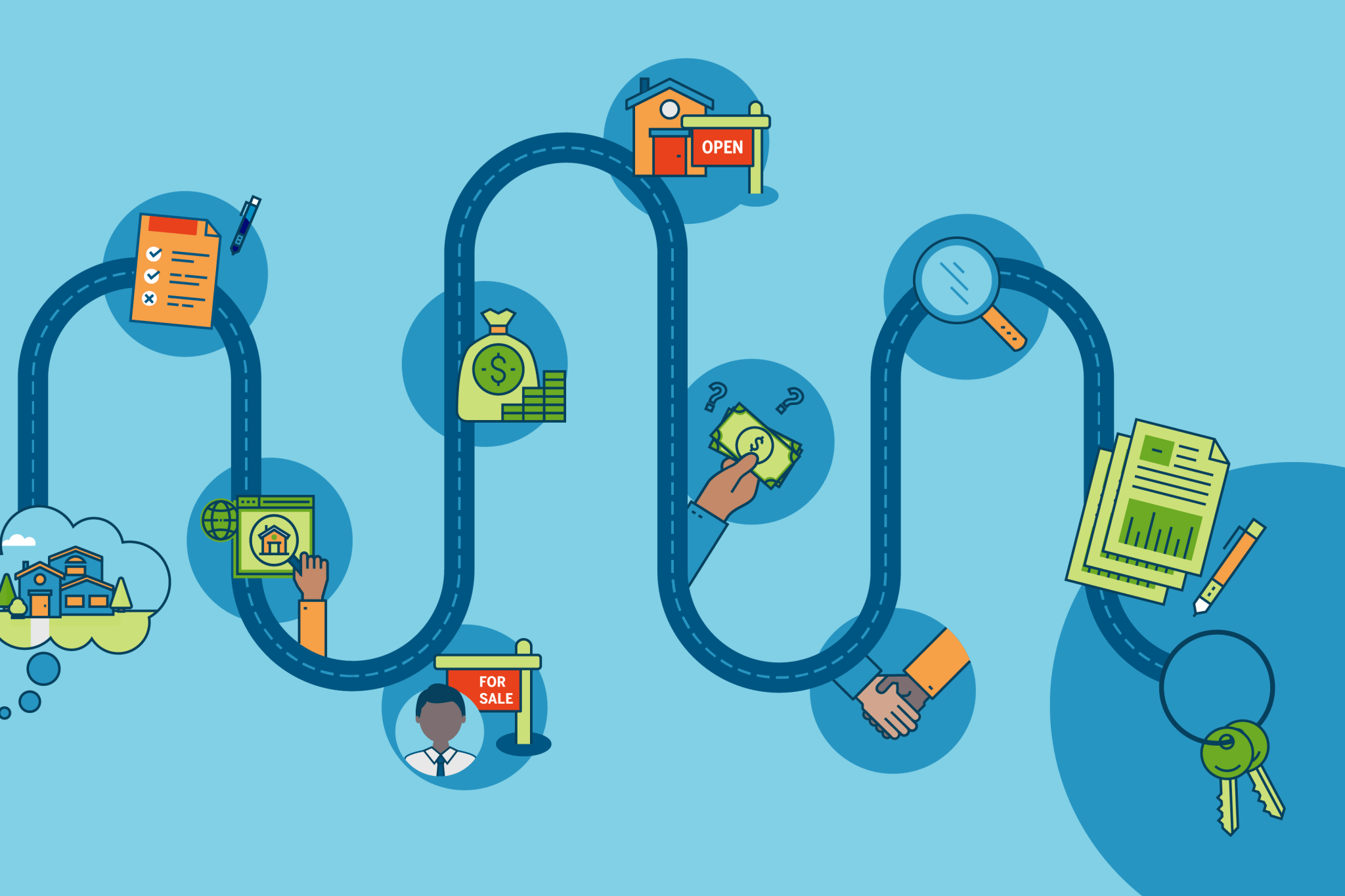

That’s where this guide comes in. We’ll not only show you the major steps you’ll take during the home buying process, but also explain the relationships and experts you’ll need along the way. We’ve even made a handy infographic that outlines home buying from start to finish.

You ready to live the dream? Here we go.

Do Your Homework | Start Shopping | Find a Great Agent | Choose a Lender | Pick a Loan (It's Not So Bad) | Visit Open Houses, and Look Around | Make an Offer | Negotiate, Negotiate, Negotiate | Get the Place Inspected | Ace the Appraisal | Close the Deal

Do Your Homework

Oh, sure, everybody wants to jump right into open houses. But before you set foot in a foyer, you should identify your list of musts and wants. This list is an inventory of priorities for your search. And there’s so much to decide: Price, housing type, neighborhood, and school district — to name a few.

To get yourself grounded, we recommend filling out this brief worksheet.

If you’re planning to buy a home with a partner (in life or in real estate), fill out the worksheet with them. You want to be on the same page while buying a house. If you’re not, you might have some trouble giving agents or lenders the information they need to help you. And you'll risk wasting time viewing homes you can’t afford — or don’t even want.

Start Shopping

Once you know what you’re looking for, the next step is to start checking out listings and housing information online. (This part? You’re going to crush it.)

Explore More Topics:

See All Steps to Buying a Home

Find a Great Agent

Your relationship with your real estate agent is the foundation of the home buying process. (And your agent can be your rock.) He or she is the first expert you’ll meet on your journey and the one you can rely on most. That’s why it’s important to interview agents and find the agent who’s right for your specific needs.

Choose a Lender

Once you’ve found your agent, ask them to recommend at least three mortgage lenders that meet your financial needs. This is another big step because you’ll be working closely with your lender throughout the home buying process.

Pick a Loan (It’s Not So Bad)

Once you’ve decided on a lender (or mortgage broker), you’ll work with your loan agent to determine which mortgage is right for you. You’ll consider the percentage of your income you want to spend on your new house, and you’ll provide the lender with paperwork showing proof of income, employment status, and other important financials. If all goes well (fingers crossed), you’ll be pre-approved for a loan at a certain amount.

Go to Showings and Look Around

Now that you have an agent who knows your housing preferences and a budget — and a lender to finance a house within that budget — it’s time to get serious about viewing homes. Your agent can provide listings you may like based on your parameters (price range, ZIP codes, features) and can help you interpret the quality of listings you find online.

Then comes the fun part: showings. They give you the opportunity to evaluate properties. Your agent can help you navigate virtual and in-person showings.

Make an Offer

Once you find the home you want to buy, you can work with your agent to craft an offer that specifies not only the price you’re willing to pay but also the proposed settlement date and contingencies. These are other conditions that both parties must agree on. For example, you'll need to be able to do a home inspection and request repairs.

Negotiate, Negotiate, Negotiate

Making an offer can feel like an emotional precipice, almost like asking someone out on a date. Do they like me? Am I good enough? Will they say yes? It can be stressful. Some home sellers simply accept the best offer they receive, but many make a counteroffer. If that happens, you'll decide whether you want your agent to negotiate with the seller or walk away. This is an area where your agent can provide real value by using their expert negotiating skills on your behalf and making the best deal for you.

Get the Place Inspected

If the seller accepts your offer, you’ll sign a contract. Most sales contracts include a home inspection contingency, which means you’ll hire a licensed or certified home inspector to inspect the home for needed repairs. Then you'll ask the seller to have those repairs made. This mitigates your risk of buying a house that has major issues lurking beneath the surface, like mold or cracks in the foundation. (No one wants that.) Here’s what to expect.

Ace the Appraisal

When you offer to buy a home, your lender will need to have the home appraised to make sure the property value is enough to cover the mortgage. If the home appraises close to the agreed-upon purchase price, you're one step closer to settlement, but a low appraisal can add a wrinkle. It's one you can usually deal with, though. Here’s how to prepare.

Close the Deal

The last stage of the home buying process is settlement, or closing. This is when you sign the final ownership and insurance paperwork and make the whole thing official. There’s some prep work you have to take care of first.

When it’s all said and done — break out the rosé. You’ll have the keys to your new home!