Your Stress-Free Guide to Shopping for Home Loans

In Buy a Home: Step-by-StepWith this super-simple breakdown of loan types, you’ll find the right mortgage.

Whether you’re financing home improvement, refinancing, or getting a new mortgage, you want to do it right and for the right reasons. Experts and real homeowners bring you the financing tips, advice, and ideas you need to negotiate and navigate your options.

Before you start house hunting, use tools and formulas to estimate how much house you can afford.

Learn why a mortgage preapproval is an important step to set you up for success in a home purchase.

These tips and steps in buying an owner-occupied multifamily home could speed up your entry into first-time home ownership.

Interest rates are only one factor when it comes to buying a house now.

You’ve got options, like repayment help from your employer and coaching from a mortgage broker.

Home buyers who do mortgage loan shopping can avoid leaving money on the table.

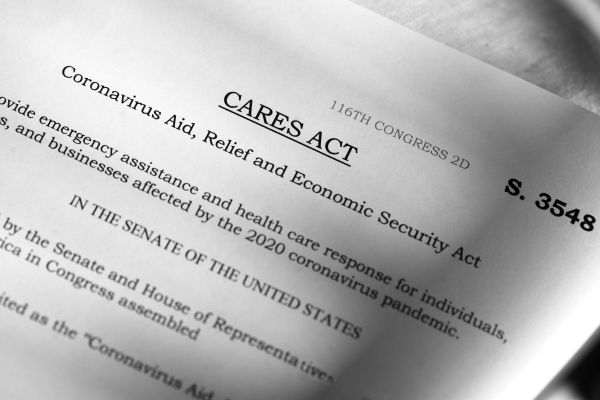

It’s a confusing time, but lenders are putting remedies, like forbearance, in place to help homeowners.

Whether you’re self-employed or applying for an FHA or USDA loan, here’s the pre-approval paperwork you need.

The credit score to buy a house can be as low as 580.