Let’s face it. The fun part of buying a home is looking through all the homes for sale to uncover your special gem. Not so fast, though. Without a little prep work, you could set yourself up for unpleasant surprises. After all, if you skip getting a mortgage preapproval before starting your search, you may fall for a home that a lender says you can’t really afford.

That’s why Todd Luong, a real estate pro with RE/MAX DFW Associates in Frisco, Texas, encourages his clients to get preapproved before shopping for homes. “It helps determine what a buyer can afford,” Luong says. “Getting preapproved provides a clear estimate of a buyer’s potential monthly payments. That allows them to focus on properties in their price range and avoid wasting time on homes that can exceed their financial limits.” Plus, it helps you identify any potential issues early in the process that could jeopardize your ability to get a mortgage — and hopefully get them resolved quickly.

We get it that the mortgage process can be confusing (especially if you’ve never been through it before). Learn the ins and outs of the mortgage preapproval process to make this first step less scary.

What Does It Mean to Get Preapproved for a Mortgage?

Mortgage preapproval requires a lender or mortgage broker’s thorough review of your finances to determine if you qualify for a mortgage and for how much. “Many people think they are good to buy because they make a certain amount of money, but there is more than income that goes into being preapproved,” says Mike Opyd, senior vice president at RE/MAX Premier and co-owner of Motto Mortgage Next in Chicago. “A lender will look at everything, such as income, debts, and credit scores to determine what a person can qualify for.”

You can also use your preapproval letter to show home sellers you’re serious about buying when you submit an offer for a home.

Documents You Need for Mortgage Preapproval

To get preapproved, you’ll need to meet with a lender — for example, from a bank you’re already using or a mortgage loan officer at another bank, a credit union, a mortgage broker, or an online lender. (Ask your real estate agent for recommendations if you’re unsure.) During the preapproval process, a lender will review your finances by pulling your credit report and asking you to submit several documents:

- Proof of identity, like a driver’s license or passport

- Proof of income (for example, at least two or three months of pay stubs or W-2 forms or tax returns from the past two years)

- Proof of employment, such as the contact information for your employer or a recent employment verification letter

- Proof of assets, such as bank statements for any checking, savings, and retirement accounts for the past two to three months

- A list of current debts, such as outstanding balances and monthly payments for credit cards, car loans, alimony payments, student loans, and so on

- Down payment details, including documentation showing where the funds are coming from (for example, savings account statements or gift letters if from a family member or friend):

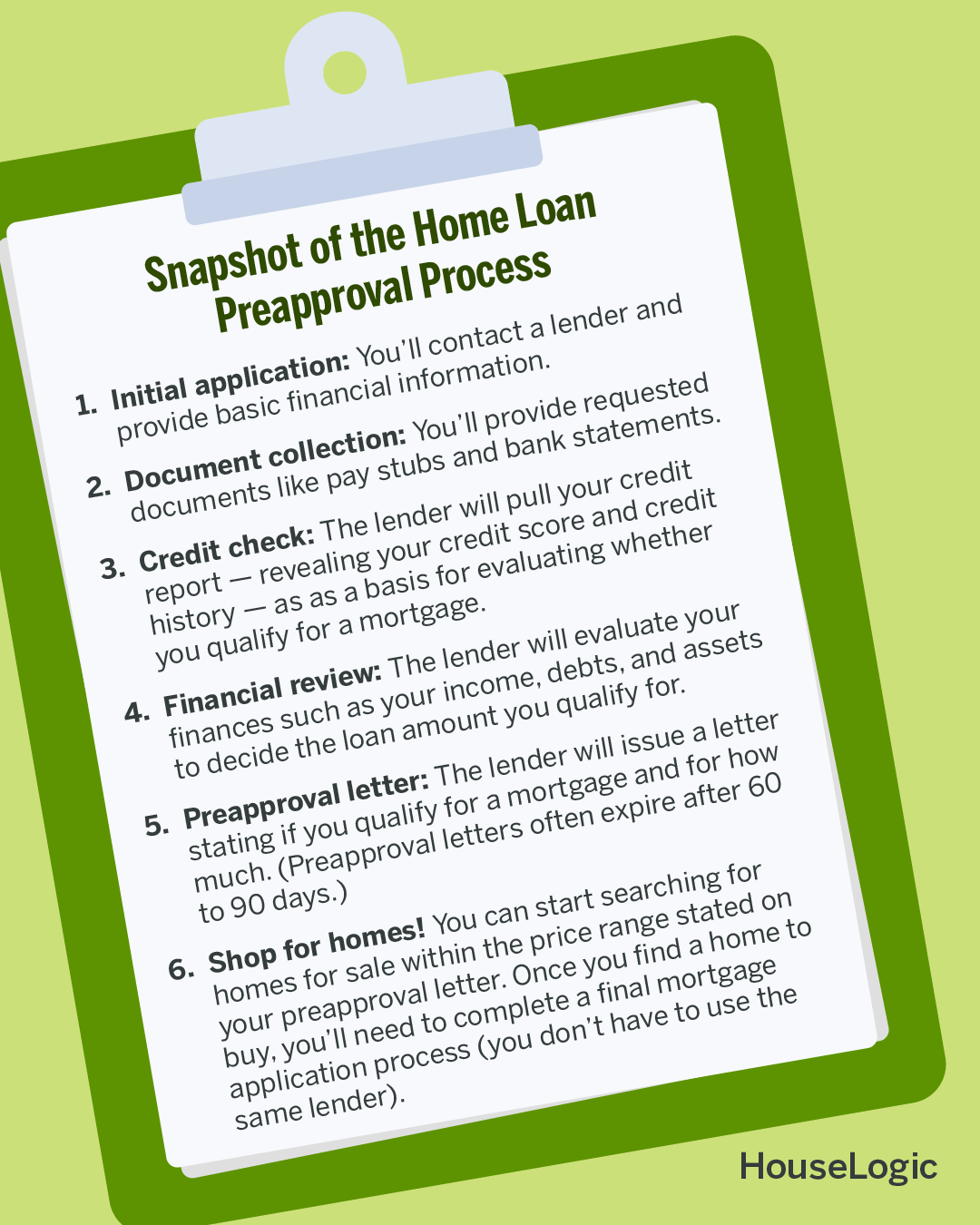

Snapshot of the Home Loan Preapproval Process

Here are the primary steps in the process:

- Initial application: You’ll contact a lender and provide basic financial information.

- Document collection: You’ll provide requested documents like pay stubs and bank statements.

- Credit check: The lender will pull your credit report — revealing your credit score and credit history — as as a basis for evaluating whether you qualify for a mortgage.

- Financial review: The lender will evaluate your finances such as your income, debts, and assets to decide the loan amount you qualify for.

- Preapproval letter: The lender will issue a letter stating if you qualify for a mortgage and for how much. (Preapproval letters often expire after 60 to 90 days.)

- Shop for homes! You can start searching for homes for sale within the price range stated on your preapproval letter. Once you find a home to buy, you’ll need to complete a final mortgage application process (you don’t have to use the same lender).

How Much Mortgage Can You Be Preapproved For?

The amount a lender will preapprove you for will be based on multiple factors including:

- Income: Your gross monthly income and any other income you receive.

- Credit score: Higher credit scores — 700 or above — tend to qualify for larger loan amounts and lower interest rates, even though lower scores are acceptable.

- Debt-to-income ratio: Your monthly debt payments — like car payments, student loans, and credit cards — will be compared to your gross monthly income to make up your debt-to-income ratio. Lenders typically prefer a DTI ratio of 36% or lower. Some specialized lending products — such as Federal Housing Administration loans — may accept DTI ratios of 43%.

- Down payment: Making a large down payment could help you get approved for a higher loan amount. Also, down payments of at least 20% of the home purchase price will keep you from having to pay an additional monthly mortgage fee, known as private mortgage insurance, or PMI.

- Assets and savings: Lenders may view savings accounts, retirement accounts, and other investments as extra financial cushions; these could give them more confidence in approving you for a larger mortgage amount.

- Loan type: The type of mortgage you’re applying for — such as a conventional loan, an FHA loan, or a Veterans Affairs loan — could also affect the amount a lender will approve for a mortgage. For example, buyers with lower credit scores and smaller down payments may qualify for an FHA loan, but it may come with lower loan limits, since lenders are taking on more risk.

Could a Mortgage Preapproval Give You Leverage With a Seller?

Preapproval letters can give home sellers extra assurance. “Some listing agents and sellers will not consider an offer without a preapproval,” Opyd says. “There is no point negotiating with someone unless they can show they are qualified. Otherwise, it can be a huge waste of time for a seller to accept an offer only to find out later the buyer cannot qualify [for financing]."

A mortgage preapproval could also help you negotiate, Luong says. “In competitive situations, a preapproval letter gives the buyer an advantage by demonstrating that they already have been approved for financing." That gives you an edge over buyers without one. What’s more, “sometimes the buyer may even be able to negotiate a lower purchase price. That’s especially true if the seller is eager for a quick, smooth transaction and trusts that buyer can close,” he adds.

Avoid Potential Mortgage Preapproval Problems

During the preapproval process, the lender will scrutinize your finances, and a mortgage denial could halt your home ownership dreams. Besides gathering documents, you also could do a few extra checkups beforehand to validate that you’re financially ready to take this leap.

Top Reasons Mortgage Applications Get Rejected

Here are the top reasons lenders reject mortgage applications, according to the National Association of REALTORS® “2024 Profile of Home Buyers and Sellers.”

- High debt-to-income ratio: 40%

- Low credit score: 23%

- Income was unable to be verified: 12%

- Not enough money in reserves: 12%

- Insufficient down payment: 9%

Prepare for the Mortgage Preapproval Process

You can prepare with these four steps:

- Obtain a free credit score: A credit score of at least 620 is often recommended in qualifying for a mortgage, though higher scores can benefit you with the loan amount and interest rate. But some lenders will approve borrowers with lower scores. For example, FHA loans allow for a minimum credit score of 580 and offer low down payment options, such as 3.5% of the purchase price. Generally, the higher your credit score, the larger the loan amount and the better mortgage rates you can qualify for. A score of 760 or higher tends to snag the best rates.

- Do a checkup: AnnualCreditReport.com offers free credit reports. You’re entitled to one free credit report from each of the three major credit bureaus — TransUnion, Experian, and Equifax — every 12 months.

- Check your credit report for any errors: Dispute any errors that may be unfairly causing your credit score to be lower than it should be. The three credit bureaus each have an online dispute process listed on their websites. If necessary, you can also take steps to improve your credit score: Watch this video to learn how.

- Evaluate your debt-to-income ratio: Having a high DTI is the top reason lenders deny a mortgage, according to NAR research. DTI ratio calculators are available online to help you estimate your DTI. If you have a high DTI, pay down your debt, refinance, consolidate debt, or reduce any expenses to make yourself more mortgage ready.

Mortgage Preapproval vs. Mortgage Prequalification

These terms aren’t interchangeable, though they’re sometimes used that way. A preapproval —with its additional levels of checks and balances from lenders — is viewed as more beneficial for a home buyer who is ready to purchase soon.

But for those who just want to explore options or get a general idea of their budget, getting prequalified for a mortgage may suffice. Prequalification provides a broad assessment of your finances and a rough estimate of what you can afford. A preapproval goes into more depth, because a lender will review and verify your finances, documents, and credit report to provide a more accurate loan amount.

Mortgage Prequalification

- Purpose: An informal, quick assessment to explore your borrowing power

- Process: A lender asks you to self-report basic financial information, like about your income and debt

- Credit check: None

- Documents needed: None

- Result: A rough estimate of how much you can afford

Mortgage Preapproval

- Purpose: A more formal process to determine if you qualify for a mortgage and for how much

- Process: A lender verifies and reviews your credit, financial documents, debts, and more

- Credit check: A lender will verify your credit score and credit history

- Documents needed: Proof of income, assets, debts, and more

- Result: A more accurate estimate of the mortgage amount you can afford

FAQs About the Mortgage Preapproval Process

Darcie Gore, executive director and senior lending manager at JPMorgan Chase, answers some common questions about the mortgage preapproval process.

What Do Lenders Consider in Mortgage Preapproval?

The process for getting preapproved can vary from lender to lender. Typically, a lender will review information about the applicant’s financial status to determine their qualifications, which can include items such as income, job history, monthly bills, and expected down payment.

What Mistakes Do Borrowers Make During Mortgage Preapproval?

During the preapproval process, prospective home buyers should avoid making any significant changes in their personal finances, like opening new credit cards or taking out loans. It can affect your credit score and DTI ratio. Making a large purchase, like a car, can also affect your DTI, as well as cash reserves if using cash payments.

Applicants should also make sure to completely fill out the preapproval application with information that’s as accurate as possible. This can help prevent unnecessary delays in the process. Lenders will continue to evaluate a borrower’s eligibility until a house is closed on, so it’s important to stay in good financial standing throughout the home buying process.

Can a Borrower Be Denied a Loan After Mortgage Preapproval?

While mortgage preapproval may help indicate what type of mortgage a borrower may qualify for, it doesn’t guarantee final approval for a loan. Many factors can impact what ultimately happens with a mortgage.

For example, a consumer might be denied a mortgage if the borrower waits too long. Their preapproval letter may expire (preapprovals typically are valid 60 to 90 days). Or, if the borrower’s finances change or don’t ultimately match what was provided to obtain the preapproval letter, the borrower may be denied.

However, getting preapproved for a mortgage can be a smart step for borrowers looking to purchase a home. Some sellers might require it, or it may help borrowers understand what types of loans they qualify for before making any offers or making a decision outside of what they can afford.

Does Mortgage Preapproval Affect Your Credit Score?

Some mortgage preapprovals may result in a hard credit inquiry and affect a borrower’s credit score. However, the mortgage preapproval’s impact alone shouldn’t fundamentally change the status of your credit.

Exploring multiple lenders is often beneficial and shouldn’t significantly impact a prospective home buyer’s credit score. It allows you to compare loan terms, rates, and fees to make sure you’re securing the best deal for your mortgage.

Do You Have to Stick With the Lender Who Processed Your Mortgage Preapproval?

Preapprovals are just a preliminary assessment rather than a binding commitment, so borrowers aren’t tied to the lender who preapproved them. After being preapproved, home buyers can and should shop around to find the best lender who can offer the best possible deal.

When Should You Lock in Mortgage Rates?

Once buyers find the right home, we advise they lock in their rate shortly thereafter. Mortgage rates fluctuate every day and, as we have seen so far this year, can be very volatile. If buyers find a house they love and are comfortable with the payment on the home based on today’s rates, we suggest locking in that rate so they have certainty of what payments will look like on the home loan.